Pick someone you trust with sensitive financial information and who can accommodate your needs. At Pilot, your dedicated account manager is always available to support you and answer any questions. FreshBooks comes with 2 basic plans to meet the needs of different business types and sizes. Whether you’re a small or growing business, you can benefit from FreshBooks’ top features without breaking the bank. When you use an external party, the process doesn’t include hiring, supervising, and onboarding expenses.

- Conducting frequent security assessments helps identify potential vulnerabilities and ensures compliance with established security protocols.

- However, as with any in-person accounting professionals you’d trust with your financial data, you should always verify a bookkeeping firm’s credentials before committing to a monthly plan.

- FreshBooks can help you find an online accountant nearby who is ready to help your endeavour grow and succeed and fulfil all your accounting needs.

- This means access to invaluable financial data that can help you stay on top of your cash flow and guide your decision-making.

B. Key data security measures to expect from partners

As a leading think tank, the Thomson Reuters Institute has a proud history of igniting conversation and debate among the tax and accounting.. Ask anyone who has launched a small business and they will remember how exciting the early days were. Look for reviews, references, and case studies to gauge their performance and reliability. A strong reputation often indicates a commitment to quality and customer satisfaction, which is essential for a successful outsourcing relationship.

Bookkeeper.com: Most versatile outsourced bookkeeping solution

Choosing the right outsourcing partner can ensure that data entry is handled efficiently while also providing access to financial planning expertise. This balanced approach can lead to better financial management and ultimately contribute to the success of the business. Tax preparation is another critical service that can be outsourced, allowing businesses to benefit from the expertise of tax professionals who stay updated on the latest regulations. Additionally, financial reporting, which provides insights into the company’s financial health, is often outsourced to ensure accuracy and compliance with accounting standards. Yes, virtual and outsourced bookkeeping is just as legitimate as in-house bookkeeping and accounting. However, as with any in-person accounting professionals you’d trust with your financial data, you should always verify a bookkeeping firm’s credentials before committing to a monthly plan.

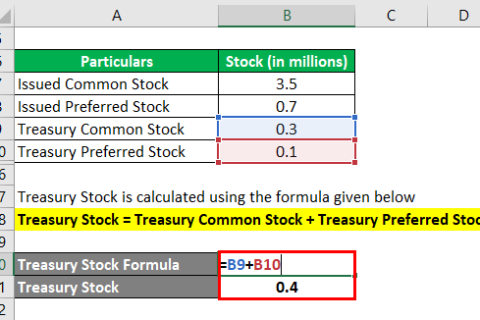

Many business owners hire full-time in-house bookkeepers, but this isn’t the most cost-effective solution. A strong bookkeeping system is of vital importance for any company or organization. workers compensation coverage through a peo Expect measures such as encryption, secure data storage, regular security audits, and strict access controls to safeguard your financial data. After identifying potential partners, initiate discussions to understand their processes, technology, and communication practices. Establishing a strong rapport and clear expectations during this phase is crucial to ensure a smooth transition.

What key data security measures should I expect from outsourcing partners?

The magic happens when our intuitive software and real, human support come together. Our team is ready to learn about your business and guide you to the right solution. Outsourced bookkeeping offers the flexibility to easily adjust your services to accommodate growth and adapt to changing needs. Hiring an in-house bookkeeper requires not only paying salaries (in the U.S., the average bookkeeper salary is $44,607) but also adding benefits, training, equipment, and other employee-related expenses. Outsourced bookkeeping is a cost-effective way to streamline your business’s financial record-keeping.

Outsourced, virtual bookkeeping can cost as little as $150 per month and as much as $900 (or more) per month. Some companies charge by the number of accounts you need them to manage, while other companies charge based on your company’s monthly expenses. Typically, the lower your expenses (and the fewer your accounting needs), the less you’ll be charged. Experienced bookkeepers are often better at finding overdue clients and cuts your company could make to increase overall profit. Plus, having an outsourced bookkeeper is more cost-efficient in the first place, since you’re not technically their employer. Luckily, accounting and bookkeeping don’t have to be the business owner’s responsibility anymore.

By utilizing advanced encryption methods, you can protect sensitive data from being intercepted or accessed by unauthorized individuals. Regularly updating your encryption protocols will also help in staying ahead of potential cyber threats. To learn more about how we can help, speak to one of our friendly experts today — or check out our in-depth payroll processing guide. We do all the heavy lifting for you, giving you peace of mind and allowing you to focus your time, money, and resources on running and growing your business. At some point, you may find it more beneficial to move some or all of your accounting processes in-house.

本站尊重原创,素材来源于网络,好的内容值得分享,如有侵权请及时联系我们给予删除!

微信扫一扫

微信扫一扫  支付宝扫一扫

支付宝扫一扫